Bioenergy

The term biomass refers to

all the Earth's vegetation and many products and coproducts that come from it.

Biomass is the oldest known source of renewable energy�humans have been using

it since we discovered fire�and it has high energy content. The energy content

of dry biomass ranges from 7,000 Btus/lb for straws to 8,500 Btus/lb for wood.

Domestic biomass resources include agricultural and forestry wastes, municipal

solid wastes, industrial wastes, and terrestrial and aquatic crops grown solely

for energy purposes, known as energy crops.

Biomass is an attractive energy

source for a number of reasons. First, it is a renewable energy source as long

as we manage vegetation appropriately. Biomass is also more evenly distributed

over the earth's surface than finite energy sources, and may be exploited using

less capital-intensive technologies. It provides the opportunity for local, regional,

and national energy self-sufficiency across the globe. And energy derived from

biomass does not have the negative environmental impact associated with non-renewable

energy sources.

According to the U.S. Department of Energy, "developing a strong biomass industry in the United States will have tremendous economic benefits including trade deficit reduction, job creation, and strengthening of agricultural markets. Growth of the biomass industries can create new markets and employment for farmers and foresters, many of whom currently face economic hardship. Growing biomass energy crops provides new uses for agricultural land currently out of production which can help conserve farm land for future generations. Biomass usage can spur the development of new processing, distribution, and service industries in rural communities. Additionally, using biomass residues rather than disposing of them in landfills can also reduce a major land use problem. "

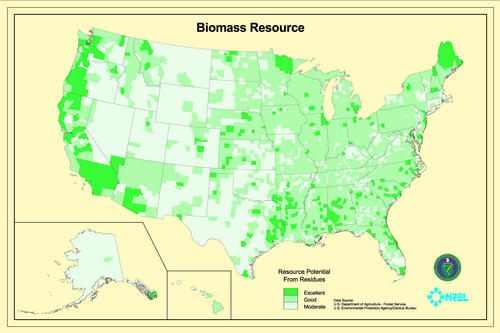

The map below shows biomass potential for the U.S.

To learn more about biomass and bioenergy, visit the Department of Energy's Biomass Program website.

Incentives

Federal

To encourage ethanol use, the federal government exempts 5.3 cents per gallon of 10-percent ethanol blend (53 cents per gallon of ethanol) of the 18.3 cents per gallon federal fuel excise tax. In effect since 1979, this credit makes ethanol competitive for fuel additive use.

The Energy Policy Act of 2005 will provide a federal excise tax credit for biodiesel as a tax incentive for petroleum distributors who blend biodiesel with diesel fuel into both on-road and off-road markets. The incentive equates to $1.00 per gallon of biodiesel made from virgin vegetable oils (like soy) and animal fats, and $0.50 per gallon for biodiesel made from recycled oils (subject to funding appropriation.) Newly purchased, qualified electric vehicles and clean-fuel vehicles (including gasoline/electric hybrids) are eligible for federal income tax incentives:

Purchasers of hybrid and advanced lean-burn diesel vehicles can receive a federal tax credit of up to $3,400. This will be capped at 60,000 vehicles per manufacturer and will expire in 2014. For medium and heavy hybrid trucks the tax credit will expire in 2009, and for leanburn diesel vehicles, the tax credit will expire in 2010. Electric vehicles are eligible for a one-time tax credit of 10 percent of the vehicle cost, up to $4,000 per vehicle.

For more information, visit these links from Guide to Federal Biofules Incentives, which was developed through Washington State Senatot Maria Cantwell who has worked diligently to create incentives to encourage biofuel production, the installation of biofuel pumps at gas stations, and the use of biofuels. To help individuals and corporations navigate and access the various federal programs and grants available, Senator Cantwell has released this comprehensive guide.

|